Digital Gold — A door to democratic investing that’s a-jar

What's the deal with digital gold and should you invest?

By HPK

I’m someone who finds it difficult to look at things that don’t make sense rationally. More so when there’s little scope for emotions and subjectivity. Investing squarely falls in this area.

I recently came across a case of a curious customer behaviour — that of investing in Digital Gold (this post assumes good returns as the only expectation from investing in digital gold and nothing else). I maybe missing something here and I’m more than happy to learn what I’m missing. This post is a critical observation on digital gold as a product and not on any particular business operating in this area. These are my observations based on my understanding and there is no intent to malign or cause any reputational losses to anyone. This post doesn’t imply any ill-intent on the part of the business(es) referred in this post.

Now that we’re done with the disclaimers, let’s dive into this.

What’s Digital Gold?

Gold that’s held by the buyer digitally and backed by real physical gold, 99.95% purity.

How’s it different from physical gold?

You don’t have to worry about delivery, collection, and storage. That is, if you want to invest in gold to get the upside only or don’t plan to physically possess gold immediately. It also helps that you can buy digital gold worth as low as Rs. 10, which is impossible with physical gold.

What’s the pitch?

“We’ll let you invest in digital gold in small amounts and help you save better and your savings will be their worth in gold, literally”. Well, this is not exactly the pitch but something I’d have given as the pitch.

“What’s your problem when people are being allowed to save their money and get gold?” you ask.

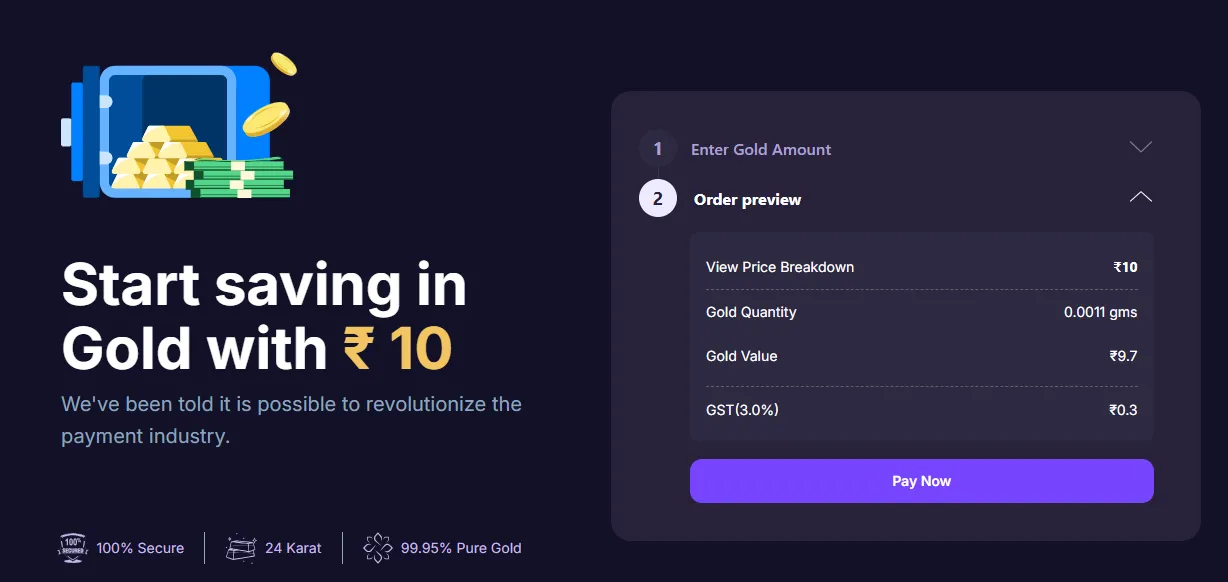

- GST — Buying Digital gold attracts 3% GST. So, to get digital gold worth Rs. 97, you have to spend Rs. 100. 3% gone with the wind!

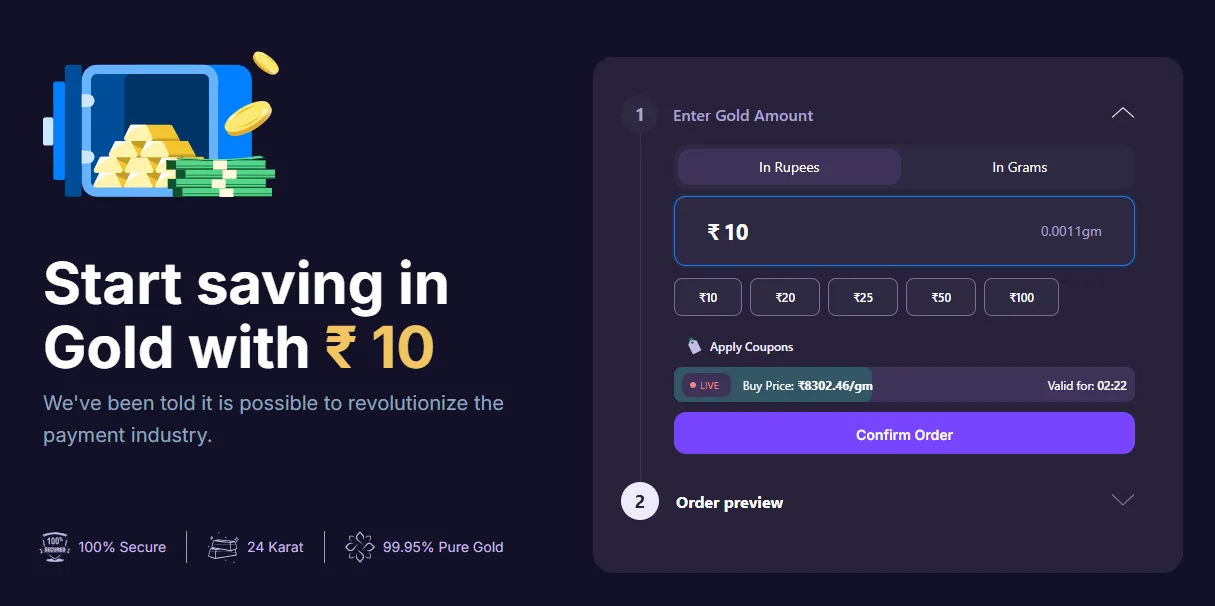

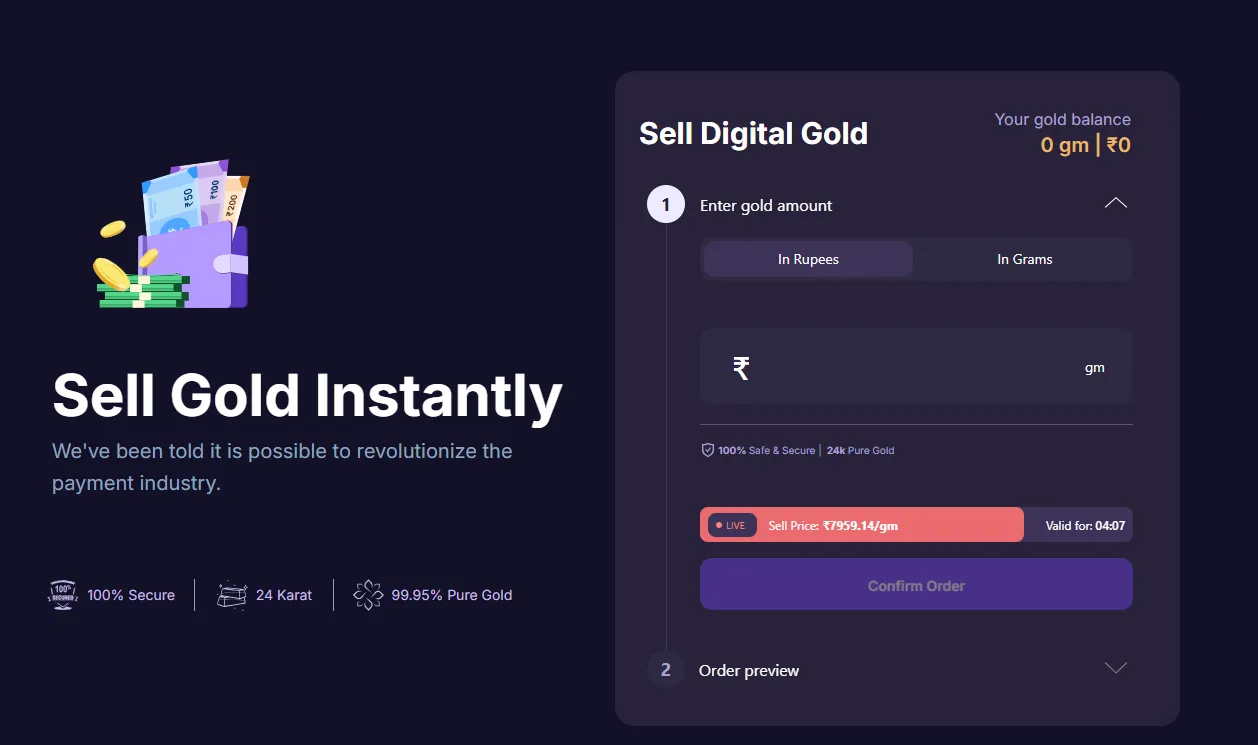

- There’s markup involved while buying (compared to the sell price). Look at the pictures below — A gram of gold costs about Rs. 8302 while you’re buying and only gets you about Rs. 7960 when you knock on the businesses to sell your gold. The same 1 gram! This is about 4% cost just because you wanted to get exchange gold for money.

Let’s take an example and see how this turns out for an investor, taking the buy and sell prices mentioned in the above pictures.

- I spend Rs. 10 to get Rs. 9.7 worth of gold at Rs. 8302.46/g , or, 0.0011 g of Gold. This is because of cutting off 0.0011683 g to four decimal places — there’s a cost of 6% ! The effect of cutting to 4 decimal places will be less as the amount you invest increases as the base gets higher. Say, for Rs. 100 investment, at similar buy and sell prices of gold, this cost would be less than 1%, for a Rs. 1000 investment, this cost is less than 0.1%. Given that one of the USPs that digital gold tout is ability to invest smaller sums, it’d be fair to assume that the distribution of buy transaction amount skews towards smaller amounts, say, a median case of Rs. 100, contributing to about 0.5% cost (for comparison, some mutual funds have their expense ratios close to this). Remember, all of this just because of some decimal places!

- Moments later, I want to get back my money (since I can withdraw 24 X 7 — why wouldn’t I want to make use of the USP). I can sell my gold only at Rs. 7959.14/g to get 0.0011*7959.14 = Rs. 8.76. My invested Rs. 10 became Rs. 8.76 in moments — not even involving asset class risk, macroeconomic event, or any such fancy finance jargon. That’s a 12% cost on your invested sum of Rs. 10! With our assumption of a median buy amount of Rs. 100, you get back Rs. 92.32, still over 7.5% cost of investing!

Too much to read, right? Here’s a summary for us low attention span folks—

For every Rs.100 invested in digital gold:

- ~Rs. 2.9 goes towards GST

- ~Rs. 0.5 goes to rounding off (why not!)

- ~Rs. 4 goes in the pocket of the business offering you this service

A total cost of over 7% for any product is a serious one! What this means is, gold (sell price) should appreciate by this amount to just get back the money you initially invested (Rs. 10). How much does gold appreciate? Maybe it makes sense to lose this paltry 7% by investing in digital gold in anticipation of some bumper returns? Let’s look at the data!

Now, let’s look at how our shiny metal has fared over the years. We won’t go back as far as Roman kings and Ananthapadmanabha Swamy treasure times — let’s take a modest 30 year period.

Gold has given y-o-y returns ranging from -14% to 42% from 1995 to 2024 (Oct), with 12 of those years giving returns less than 7%, below the total cost that one would incur if they invested in digital gold with no price fluctuations. So, in the last thirty years, if you were to invest in digital gold, 40% of the time you wouldn’t even get back the sum you invested! A CAGR of about 10% over the last thirty years — that’s the story of this metal. How’s the more recent performance, you ask? These are the last five year returns — 38.13%, 0.14%, 8.11%, 24.04%, 23.14% (starting from 2020). This is a good amount of fluctuation, about 14% or twice the cost you’d incur just by virtue of investing in digital gold. (Data from this blog)

What are the takeaways from these numbers? Gold returns have been modest at best in the long term, with some great returns over the last couple of years, owing in part to the geopolitical instability.

So, if you’re invested in digital gold has to appreciate by at least 7% for you to breakeven, gold returns are modest in the long term (with good returns in the short term). And there are multiple businesses with different business models that are doing well. One has its reach in relatively remote areas and in vernacular languages. So, what drives this behaviour? “Why would anyone want to lose 7% by just investing?” — this is what has been bugging me and here are my thoughts.

— Gold has good standing with almost everyone in the country. It has an image of an asset class that can give bumper returns with a limited downside

— Other forms of investing — stocks, mutual funds, bonds, etc. either have high entry costs (financial literacy, to start with) or require larger sums of capital for investment

— Other forms of investing in gold — Gold ETFs, for example, are not well understood and not well known

— People might actually not know that the cost of investing in digital gold could be 7%

While the first three are structural and it’d take time for financial literacy to penetrate, the last one bothers me. If the businesses were making it clear to people that effectively they’d be losing around 7% by investing in digital gold, I bet not so many people would be interested in their offerings. While GST can’t be avoided and margins are part of any business, the communication and the narrative around this product is troubling. Also, given that it’s the relatively economically weak people (with limited financial literacy, even) who are primary targets, it becomes a moral responsibility to clearly convey about the impact of buy-sell margins and GST on their investments in this product. Instead, in a troublesome way, digital gold is being marketed as the great equalizer that’s opening the doors to millions of people with low capacity to invest.

If I were to operate in this business of selling digital gold (which I don’t want to and hence ‘were’), I’d do the following:

- I wouldn’t target people with low investing capacity as my prime customers.

- I’d clearly communicate the costs involved in this product: GST (3%) and margins between buy and sell prices (~4%)

To conclude, I think it’s predatory to target customers with low investing capacity for this product while not clearly communicating the costs. Businesses operating in this space, do better!

If you’ve braved reaching to this point, let me know what you think!

“Tragedy lies not in the impunity but in convincing the world that it’s kindness”